|

|

Japan auto-part makers: the power driving the automotive industry

While Toyota, Honda and Nissan are just the visible tip of the iceberg, Japan’s automotive industry is driven by hundreds of smaller firms that build and supply pioneering technology and high-quality parts and components to automakers around the world.

They say a country’s industrial and economic strength is reflected in the strength of its automotive industry. It is no coincidence then that the three largest economies in the world are also the three top manufacturers of automobiles.

The United States has the big three of Ford, GM and Chrysler; while China has a raft of domestic car companies and, perhaps unsurprisingly, produces more cars than anyone else, although many for international brands with manufacturing bases in the Dragon economy.

And while China has emerged as a major regional competitor in recent years, producing almost three times more vehicles than Japan in 2017, Japan’s automotive industry is still one of the most prominent, distinguished and technologically advanced industries in the world, reputed for high-quality and performance.

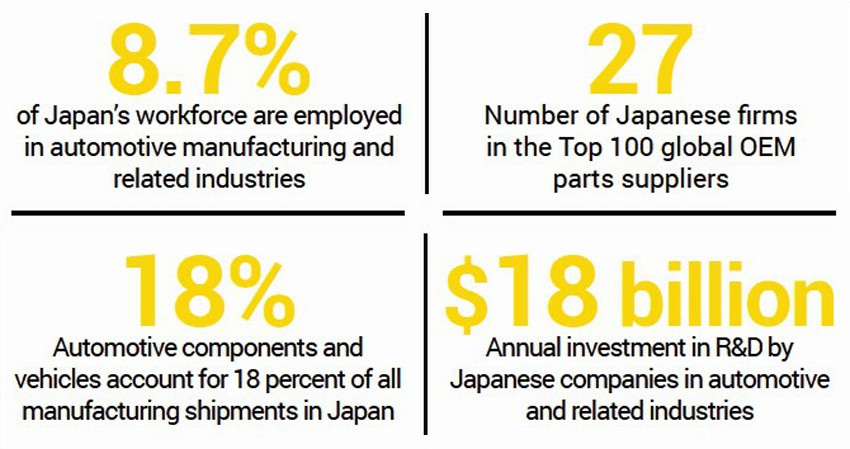

The automotive industry in Japan employs 5.5 million people, representing 8.7 percent of the workforce, and annual investment in R&D by automotive manufacturing and related industries is $18 billion, or roughly 21 percent of R&D spending in all of Japan’s manufacturing sectors.

Japan is the third largest producer of cars in the world after China and the U.S., and has been firmly placed in the top three since the 1960s. Of the top ten selling car brands in the world, three are Japanese companies. In the U.S., the top two selling brands between 2016 and 2017 were, naturally, GM and Ford; three of the following four top sellers were Japanese: Toyota, Honda and Nissan.

But Toyota, Honda and Nissan are just the visible tip of the iceberg. The nation’s automotive industry is also made up of hundreds of lesser known companies – from SMEs to multinationals – that build and supply the parts and components for these big car makers. And like Toyota, Honda and Nissan, these companies are also big exporters, supplying high quality parts to carmakers in the U.S. and across the world.

Automotive components and vehicles account for 18 percent of all manufacturing shipments in Japan. Auto parts manufacturing accounts for over 600,000 jobs in the automotive sector, and another 390,000 jobs are allocated to the production of raw materials and basic equipment used in automotive manufacturing.

Take a look inside the hood, the door panel, underneath the steering wheel or inside the gear box, and the chances are you will find parts and components developed and built by these Japanese parts manufacturers, whether you’re driving a Chrysler, a Ford or a Toyota.

"If you drive a car such as a Toyota, Honda, Nissan, Ford, Volkswagen, Fiat or Chrysler, you probably use our products without realizing," says Osamu Inoue, President and COO of Sumitomo Electric, a global leader in the manufacture of wire harnesses for automobiles.

A wire harness is an organized set of wires, terminals and connectors that run throughout the entire vehicle and relay information and electric power. They play a critical role in connecting a variety of components – a role which will become increasingly more important with the introduction of electric vehicles (E/Vs), IoT-connected smart vehicles and driverless cars that require more electronic wiring and components.

With more wires come more harnesses and thus, more weight. As such, Sumitomo Electric’s R&D department is constantly working to develop more lightweight solutions.

"In the area of wire harnesses for the automotive industry, we developed new aluminum-based products and they have been in widespread use across the globe. Since aluminum weight is half that of conventional materials, it has been used to create lightweight vehicles," explains Mr. Inoue.

Yasuhiro Ogura, President of Ogura Clutch, the world’s largest manufacturer of electromagnetic clutches and brakes, also acknowledges that E/Vs are changing the demands placed on automotive components manufacturers, who must innovate and adapt to meet these new demands. Fortunately, thanks to their technological and R&D prowess, Japanese auto parts makers like Ogura are more capable of adapting to the major changes in the industry than many others.

"To increase the production of E/Vs, the market requires safer and more reliable devices. For example, as E/Vs become more popular, part-makers will have to produce the next-generation of air conditioning compressors to work with the many electrical and electronic devices present in electric cars," says Mr. Ogura.

"At Ogura Clutch, what we are most concerned with is the decreased need for clutches in E/V coolant systems. To maintain our position as the market leader, we designed and introduced new styles of clutches approximately five years ago. One of the strengths of our company is our capacity to adapt, predict market trends and swiftly react to new demands."

The company also develops micro-clutches that are used in copy machines and other electronic devices. As Mr. Ogura points out, when E/Vs begin requiring these types of miniature clutches, Ogura will be ready to offer theirs as a solution.

"These miniature clutches are small in size but produced in high volumes. Annually we produce 10 million micro clutches," he explains.

Established in 1938, Ogura now employs 2,000 people worldwide and has capacity to build 30 million clutches annually in its manufacturing facilities located in Japan, South East Asia, China, North America, South America and Europe. Its total revenue comes from a diversified portfolio of approximately 7,000 various clutches.

"Despite having about 2,000 employees around the world and being a market leader with many of our products, we regard ourselves as a relatively small but strong company with a long history and experience in clutch manufacturing. That is our advantage over new competitors who will need experience and knowledge, as well as funds, which Ogura Clutch already possesses," adds Mr. Ogura.

With its production sites located all over the world, Ogura has been exporting the "Made by Japan" technological prowess since the 1980s, which is used by carmakers internationally.

"Our company’s objective has, and always will be, to support the monozukuri of our customers thanks to our own high level of craftmanship. For the next 20 years, we will continue our efforts in maintaining this approach to production," adds Mr. Ogura.

Like many Japanese companies, Ogura was compelled to open factories in the U.S. in the 1980s when former president Ronald Regan introduced legislation that stipulated that 70 percent of all component parts had to be assembled at local manufacturing sites. Mr. Ogura points out the similarities between Reagan’s and President Donald Trump’s policies to promote local production.

"Like Mazda, we also have a long experience working in the American market. We already have manufacturing bases in the U.S. No matter how the situation fluctuates on the political sphere, we will find a way to connect to American customers. The growth of our company has reached countries, like Brazil, China, France, and more," he says.

Getting down to the nuts and bolts of the car is where you will find Yamashina Corporation, which manufactures a wide range of fasteners, bolts, screws, pins, resin, and thin plates, as well as offering testing and analysis services. Seventy percent of its customers are in the automotive industry, which depend on Yamashima’s light-weight and non-corrosive products to literally hold the vehicle together.

The company may be more than a century old but it is still at the top of the game when it comes to the latest technology in the industry, investing heavily in innovation and R&D in order to develop highquality, reliable and light-weight materials for its products. One of its latest innovations is carbon fiber reinforced plastic (CFRP).

"We regard this need for lightweight material as a strategy for product development," says president, Naoki Hori.

"In response to such demand for lighter material, we succeeded in developing the world’s first aluminum nut especially developed for CFRP, and we started selling it. This is one of our cutting-edge products for airplanes and automobiles. The developing process has been very challenging and required a lot of effort from our side: R&D and innovation played a key-role in achieving success."

Like Ogura, another of Yamashima’s competitive strengths, and indeed Japanese manufacturers in general, is the ability adapt – to both changing customer and market needs.

"Our field of know-how can be defined as ‘suriawase’, or the ability to tune and tailor our products to fit certain characteristics. As a result, we are able to meet our customer’s needs and ensure client satisfaction."

But, as Mr. Hori points out, it’s not just cutting-edge materials that define the quality and performance of Yamashina’s products, so too does the "know-how" and technology that go into the processing, manufacturing and the assemblyline. And it is this know-how that gives Japanese companies their competitive advantage.

"Even if competitors utilize the same structure, materials, raw materials and manufacturing processes, our know-how remains unique and superior; it cannot be surpassed by anyone," explains Mr. Hori.

"This is especially visible in the automotive sector, where the meticulous, complex effort and competence that go behind the entire process represents our true advantage. We consistently aim for perfection."

|

|

|

|