|

|

Auto-parts makers: the true strength behind Japan’s automotive industry

Having built a solid reputation for supplying high-quality, high-performing components to Japan’s auto industry, Japanese autoparts makers are focusing on expanding their presence overseas, as too are other companies from the fields of aluminum materials technology and hydraulic tools.

While China has become the largest player in the Asian region in recent years, producing almost three times more vehicles than Japan in 2017, Japan’s automotive industry is still one of the most prominent, distinguished and technologically advanced industries in the world.

Japan’s automotive industry is responsable for employing some 5.5 million people, representing 8.7 percent of the workforce, and represents around 21 percent of the total R&D spending of all of Japan’s manufacturing sectors, at around $18 billion dollars.

Since the 1960s, when the industry began to really take off in the post-war years, Japan has been firmly placed in the top three largest producers in the world. Of the top ten selling car globally, three are Japanese companies: Toyota, Honda and Nissan.

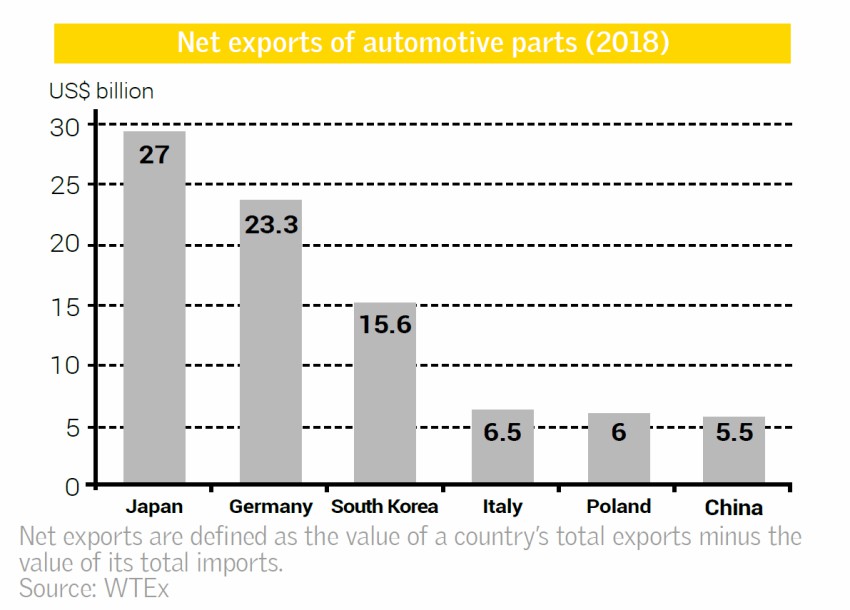

While Toyota, Honda and Nissan are major brands that represent the strength and reputation of the Japan automobile industry worldwide, the true strength of the industry lies in the hundreds of smaller companies that supply the parts and components to these big car makers, as well as to manufacturers in the U.S. and across the world.

Their badges and logos won’t be found on the top of the hood, on the front of the steering wheel or on the head of the gear stick. But take a look inside the door panel, underneath the steering wheel or in the gear box, or at the hundreds of small pieces that make up the engine, and you fill find examples of the high-quality and high-performing craftsmanship developed by these Japanese parts manufacturers.

"If you drive a car such as a Toyota, Honda, Nissan, Ford, Volkswagen, Fiat or Chrysler, you probably use our products without realizing," says Osamu Inoue, President and COO of Sumitomo Electric, a global leader in the manufacture of wire harnesses for automobiles.

"Our production of these wire harnesses is essential for automobile manufacturers to produce their cars and deliver them to their costumers."

With fuel efficiency of great importance nowadays in our environmentally conscious world, the R&D and engineering divisions of Japan’s parts manufacturers are going to great lengths to develop lightweight components and materials.

"In the area of wire harnesses for the automotive industry, we developed new aluminum-based products and they have been in widespread use across the globe. Since aluminum weight is half that of conventional materials, it has been used to create lightweight vehicles," explains Mr. Inoue.

Mazda, one of Japan’s leading car companies, is at the cutting edge when it comes to emissions-reduction, thanks to innovations such as its trademarked SkyActiv technology. As such, Mazda demands the highest standards from companies that supply it with its components – companies such as Keylex Corporation, which is also constantly striving to develop lightweight and highperforming parts that are integral to the fuel efficiency performance of Mazda’s vehicles.

"The automotive market is changing and there is an increasing demand for lighter materials and our mid-term strategy is mainly shaped around coming up with new lighter alternatives for our products that will increase the automobile’s fuel efficiency, sustainability and performance. If we are successful in this mission we should be able to continue growing steadily in the future years to come," says company president, Mitsuru Iwao.

"At this time we are focusing on making our pressed parts less heavy. These are the parts that add the most weight to cars and we are developing new ways to lighten their weight, including the introduction of lighter materials, such as aluminum for increased performance of the vehicle. Here at Keylex, we always strive to improve our line of products to satisfy the needs of our customers."

Aside from efficiency, the drivability and safety of their vehicles are other key priorities for Mazda. And Keylex supplies the carmaker with a range of lightweight and high-rigidity body parts that play a key role in not only efficiency, but also in maneuverability, safety and driving experience.

To make such high-performing products, Keylex incorporates the latest, state-of-the-art production systems, using laser welding, image inspection technology and robotics. Its Cell Production System can carry out simultaneous processing, with small high-speed robots allocated in a space-efficient manner through the use of robot simulation. The system allows the company to manufacture multiple parts within a single cell by switching jigs with handling robots.

"We believe robotics and industrial machinery are extremely important for the development of a better manufacturing system. Encouraging automation will guarantee companies such as Mazda that the efficiency and quality in their factories is up to the standard they need," adds Mr. Iwao. "We are currently present in China, Thailand and Mexico, where we are trying to implement these methods of production, but we are looking at some other potential markets to continue our expansion."

With 95 percent of its output going to Mazda, Keylex has not had to aggressively focus on its own international expansion, and instead has followed Mazda wherever it has gone. But moving forward, the company is developing and pursuing its own international strategy as it looks to bring its ever-evolving technologies to new customers worldwide.

"In 2024 the company will celebrate its 100th anniversary. In the years to come we want to focus on working towards satisfying our customers’ needs by developing new products, processes and technologies," says Mr. Iwao.

"At Keylex Manufacturing, we always try to think of the future and make use of our strengths especially in countries that have needs in that. We can definitely see that our accumulated technology may find new customers and clients in Malaysia, India or any other country in Asia. We are just starting this journey, but we are very excited about it."

Another Japanese firm, Gohsyu Corporation – which makes strong, light and high-precision forged parts for engines, chassis and transmissions – is also pursuing international expansion, with a focus on China and booming Southeast Asia.

"China produces 30 million cars per year and we believe it has great potential for the future. The South East Asian market is experiencing growth in nominal GDP and especially GDP per capita, which is very important for the automotive industry. We have expanded from our initial presence in Indonesia to other countries like Malaysia, Vietnam and Thailand and are intending to keep growing in that area," says president, Mitsuhiro Goto.

"Japanese quality is praised in many countries all over the world and people tend to give preference to our products even if they are more expensive than that of the competition. We work alongside Japanese corporations that move overseas and also tend to the demand of local companies. Our standards of production here and abroad attract companies internationally to collaborate."

Since the 1990s, Gohsyu has been approached by the big automotive companies to collaborate when going abroad and bring its manufacturing capabilities overseas. And the dependence of Japan’s big carmakers on the nation’s technology-adept SMEs is one factor that distinguishes Japan’s auto industry to that of the U.S., Mr. Goto argues.

"Other countries like the United States prefer to take a more vertical approach and develop their own manufacturing techniques instead of outsourcing it to smaller companies. Big Japanese companies that have a strong presence overseas are now exploring this method, but most still rely on the expertise of SMEs," he says.

"In our case we did not follow that wave of expansion to the U.S. and focused on improving our precisión and technology. Nowadays we supply to American companies that see the value of our products from Japan."

Like Keylex, Gohsyu’s ability to make strong, light and high-precision parts stems from the sophistication of its production system and processing technologies, which allow the company to respond to the various needs of customers. Some of its processing methods include: hot forging, used to manufacture parts such as crank shafts, axle shafts and steering knuckles; warm forging for inner rings and bevel gears; and hotcold forming for the production of speed gears and parking gears.

The company has also recently developed a series of energy-saving heat treatment processes that improve both product function and machinability, while achieving environment conservation and low costs, which include: Forged Isothermal Refining, Forged Isothermal Annealing (which converts low carbon steel and case-hardening steel into a complete refined ferrite/perlite structure suitable for recent high-speed cutting methods); and Forged Quenching and Tempering, which enables the creation of materials with strong mechanical properties and high toughness to be achieved.

Gohsyu has been successful in maintaining and replicating the high standards and sophisticated production systems used in Japan in its overseas plants; while domestically the company is exploring greater adoption of Industry 4.0 technologies in the face of the nation’s shrinking workforce.

"When it comes to our overseas expansion, it is impossible to expect the same level of skill of personnel we have in Japan, but what we have been successful in doing is standardizing our process, breaking it down and training our workers. Now we expect the same quality we produce in Japan."

Masanori Maeda, president of Nissin Manufacturing Co. Ltd., also highlights how the superior quality achieved by specialized Japanese firms is intrinsically linked to the high standards put in place at the production process.

Nissin Manufacturing, for example, employs a state-of-the-art production line system, its own unique software and well-maintained quality control systems to ensure the high-precision, high-strength and high-durability of its products, which include engine and transmission components such as valve rocker arms and shift forks all-terrain vehicle (ATV) transmission systems.

"Japanese manufacturers are known to invest an extensive amount of time and resources to monitor, analyze and, ultimately, enhance their production processes. From raw material sourcing and processing to assembly and completion, our aim is to ensure that each aspect of the production line is as close to perfection as humanly possible," explains Mr. Maeda.

"By virtue of its characteristics, the Japanese manufacturing industry, including Nissin Manufacturing, has chosen to specialize in the production of high-end products targeted at complex industries. As such, we only utilize the purest raw materials; we structure the most reliable production lines and we release complex high-precision products."

Aside for components for the automotive industry, Nissin Manufacturing provides precision parts and machine tools used in various fields, such as hydraulic/pneumatic systems, consumer appliances, dies, general purpose engines and sewing machines. And over its 50-year history, the company has gained a reputation as one of Japan’s leading manufacturers.

Looking towards the future, Mr. Maeda says the company is looking to branch into the medical industry and strengthen its presence overseas, where it currently has production sites in China, Thailand, Indonesia, Mexico and Vietnam.

"Currently, our strategy is to strengthen our already-established locations. Before further expansion, we must reinforce our local workforce, enhance our production capacities and fortify our client support systems. While we are not currently looking forward to physically moving somewhere else, we expect the continent of Africa to have great potential," says Mr. Maeda.

"Furthermore, we have plans to penetrate a new field: the medical sector. In 10-years’ time, I want to see our medical business going well and maintain our steady supply of high-quality products. Our misión is to promote global values through new business projects. To do so, our objective is to develop into a sustainable enterprise which contributes to society at large."

Beyond the automotive industry

As aforementioned, aluminum is an important material for the likes of Keylex and Sumitomo in the production of their lightweight automobile components. And one company that has been at the forefront of aluminum based materials technology for over 90 years is Toyo Aluminium K.K., whose four main usiness segments are foil products, powder and paste products, solar cell related products, and household products.

In 1964 Toyo Aluminium established the first laboratory worldwide to focus on aluminum foil and powder. Since then the company has developed high-level technologies to produce a unique product that no other company can imitate.

"By researching the unique characteristics of aluminum, we have successfully launched a variety of products useful to society, industries and individuals," says president, Hiroshi Yamamoto. "Our products can be found in a variety of markets, from packaging materials for food and pharmaceuticals, to electronic devices and renewable energy production."

The company is also focused on expanding its overseas presence. And in 2015 it restructured its R&D división in a bid to increase its strength in advanced technologies and materials for new fields and markets, such as China, South East Asia and Africa.

"We want to see our company’s sales grow 5 percent yearly, by focusing on innovation and coming up with new products and expanding internationally. We are focusing on South East Asia, China and India. Europe and the United States have matured societies with high purchasing power in which we would like to introduce new products. In Africa we believe the main necessity is for health and pharmaceutical products and we would like to collaborate with local authorities and companies to add value in the area," says Mr. Yamamoto.

"This company will be a pioneer and we believe one of our strongest competitive advantages is our constant strive to come up with new ideas and innovate."

International expansion is also a major priority for Izumi, which makes a variety of high-quality hydraulic tools and hydraulic equipment aimed at both the B2C and B2B market.

In the B2C market, one of the company’s most popular products is Japanese-made electric saber incorporating unique blade technology and built to the highest performance and reliability. In the B2B segment, its battery operated hydraulic tools are widely used, for example in electrical cables installation, offering an alternative to traditional tools and allowing customers to apply forces of up to 12 tons with just one hand, which greatly increases their efficiency. In September 2018, it launched its 7th Generation battery Operated Tool with pressure sensor, GPS functions and Bluetooth connection that enable management of operation history from a linked computer.

Izumi’s international strategy entails expanding its distribution network to bring its hydraulic tolos technology to a growing customer base in the U.S., Europe and Asia.

"Our company’s overseas expansión is mainly focused via OEM in the United States, where we have about 15 percent market share, and Europe, especially in Germany, France and the UK via local distributors," says president, Juichiro Shima. "In Asia we operate in a similar way both in China and Korea. We have local subsidiaries in China, which should help our sales increase in the area."

In October 2018 Izumi merged with Maxell to become Maxell Izumi – a milestone move that will bode well for its overseas ambitions and misión to develop innovative new products.

"This merger will allow us to come up with new products and solutions. Our combined know how and resources will be extremely positive for our clients all around the world," says Mr. Shima.

"I would like to see Maxell Izumi as the top maker of battery operated hydraulic tools globally. We are currently the leaders in the Japanese market with more than 50 percent and it’s our objective to become the number one internationally."

|

|

|

|